Interview Questions

Compliance & AML Officer Interview Questions

Hope you find this helpful! If you conduct a lot of interviews and want an AI-assistant to help you take all your notes and write and send human-level summaries to your ATS - consider trying out Aspect. It's free.

What is a Compliance & AML Officer?

A compliance and AML officer is responsible for ensuring that a company is compliant with all applicable laws and regulations, as well as implementing and maintaining an effective anti-money laundering (AML) program.The compliance and AML officer must have a thorough understanding of the company's business activities, as well as the applicable laws and regulations. They must be able to identify risk areas and develop strategies to mitigate those risks. The compliance and AML officer must also be able to effectively communicate with all levels of management, as well as with regulators.The compliance and AML officer role is a critical one for any company, and it is important that the person in this role has the necessary skills and knowledge to be successful.

“Acquiring the right talent is the most important key to growth. Hiring was - and still is - the most important thing we do.”

— Marc Benioff, Salesforce founder

How does a Compliance & AML Officer fit into your organization?

A compliance and AML officer is responsible for ensuring that your organization adheres to all applicable laws and regulations related to anti-money laundering (AML). This includes developing and implementing policies and procedures to prevent and detect money laundering, filing required reports, and training employees on AML compliance. The compliance and AML officer is also typically responsible for monitoring compliance with other laws and regulations, such as those related to data privacy and security.

What are the roles and responsibilities for a Compliance & AML Officer?

-Developing and implementing compliance policies and procedures-Liaising with regulatory bodies-Conducting compliance risk assessments-Monitoring compliance with internal policies and external regulations-Investigating compliance breaches-Preparing reports for senior management-Providing compliance training to employeesCompliance & AML Officer Interview Questions What experience do you have in compliance and AML? What do you know about our company’s compliance policies and procedures? What do you think are the most important elements of a compliance program? What do you think are the biggest compliance risks our company faces? How would you go about conducting a compliance risk assessment? What do you think are the most effective ways to prevent and detect compliance breaches? Have you ever investigated a compliance breach? If so, can you tell us about the case? How do you think senior management should be involved in a company’s compliance program? What do you think is the most important thing to remember when training employees on compliance issues?

What are some key skills for a Compliance & AML Officer?

A Compliance & AML Officer needs to possess strong analytical skills in order to identify financial crimes and risk. They must also be able to effectively communicate their findings to senior management and regulators. Furthermore, a Compliance & AML Officer needs to have a strong understanding of the relevant laws and regulations.

Top 25 interview questions for a Compliance & AML Officer

What experience do you have in compliance or anti-money laundering? What is your understanding of compliance and anti-money laundering regulations? What do you think are the key elements of an effective compliance program? How would you go about developing and implementing a compliance program? What do you think are the most important compliance risks faced by businesses today? How would you identify and assess compliance risks? What do you think are the most effective controls to mitigate compliance risks? How would you monitor and test compliance controls? What do you think are the most effective ways to investigate and resolve compliance issues? Have you ever been involved in a compliance review or investigation? If so, can you tell me about it? Have you ever had to report a suspicious transaction? If so, can you tell me about it? Have you ever had to file a SAR? If so, can you tell me about it? What do you think are the best practices for customer due diligence? What red flags would you look for in a customer’s profile that would indicate a higher risk of money laundering or terrorist financing? How would you go about conducting enhanced due diligence on a high-risk customer? What do you think are the best practices for transaction monitoring? What red flags would you look for in a transaction that would indicate a higher risk of money laundering or terrorist financing? How would you go about investigating a suspicious transaction? What do you think are the best practices for dealing with Politically Exposed Persons (PEPs)? Have you ever had to deal with a PEP? If so, can you tell me about it? What do you think are the best practices for maintaining an effective compliance program? How often do you think a compliance program should be reviewed and updated? How would you go about conducting a compliance risk assessment? What do you think are the best practices for managing and mitigating compliance risks? What do you think are the most effective ways to monitor and test compliance controls? Have you ever been involved in a compliance review or audit? If so, can you tell me about it? Have you ever had to report a suspicious transaction or file a SAR? If so, can you tell me about it? What do you think are the best practices for customer due diligence and enhanced due diligence? What red flags would you look for in a customer’s profile or a transaction that would indicate a higher risk of money laundering or terrorist financing? How would you go about conducting enhanced due diligence on a high-risk customer or investigating a suspicious transaction? What do you think are the best practices for transaction monitoring and dealing with PEPs? Have you ever had to deal with a PEP or investigate a suspicious transaction? If so, can you tell me about it? What do you think is the most important element of an effective compliance program? How would you develop and implement a compliance program tailored to the specific risks faced by your company? How often should a compliance program be reviewed and updated, and what process should be followed to ensure that it remains effective over time? How would you communicate with management and the board of directors about compliance risks and the effectiveness of controls in place to mitigate those risks? In your opinion, what is the most challenging aspect of compliance management, and how have you addressed it in your role as compliance officer? Can you give me an example of a time when you had to deal with a difficult or challenging situation in your role as compliance officer? Can you give me an example of a time when your company was faced with a compliance issue or risk that required quick action on your part? Can yo

Top 25 technical interview questions for a Compliance & AML Officer

What is your experience in compliance and AML? What is your experience in the banking industry? What is your experience in risk management? What is your experience in financial crimes? What is your experience in investigations? What is your experience in audits? What is your experience in developing and implementing compliance programs? What is your experience in monitoring and testing compliance programs? What are your thoughts on the current state of compliance and AML in the banking industry? How do you stay abreast of changes in compliance and AML regulations? What are your thoughts on the role of technology in compliance and AML? How do you manage risk in your compliance and AML program? What are your thoughts on financial crimes risk assessments? How do you conduct investigations into potential financial crimes? How do you develop and implement policies and procedures to prevent and detect financial crimes? What are your thoughts on customer due diligence? What are your thoughts on beneficial ownership? How do you perform enhanced due diligence on high-risk customers? What are you thoughts on Suspicious Activity Reports (SARs)? How do you file SARs? What are your thoughts on international sanctions? How do you ensure compliance with international sanctions? What are your thoughts on anti-money laundering (AML) training? Who should receive AML training? How often should AML training be conducted?

Top 25 behavioral interview questions for a Compliance & AML Officer

What is your experience with KYC/AML compliance? What is your experience with developing and implementing compliance policies and procedures? What is your experience with managing compliance risks? How would you go about investigating a potential compliance breach? What are your thoughts on effective compliance training and education? How do you stay up-to-date on compliance developments? What are your thoughts on risk management when it comes to compliance? How do you handle conflict within the compliance team? What are your thoughts on effective communication with other departments when it comes to compliance matters? How do you handle being the “bad guy” when it comes to enforcing compliance policies? What are your thoughts on working with regulators? How do you develop and maintain relationships with key stakeholders when it comes to compliance? What are your thoughts on change management when it comes to compliance? What is your experience with developing and managing a compliance budget? What are your thoughts on monitoring and auditing compliance risks? How do you handle non-compliance issues when they arise? What are you doing to prevent complacency when it comes to compliance risks? How do you encourage a culture of compliance within the organization? What are your thoughts on data privacy when it comes to compliance? What is your experience with developing and managing global compliance programs? What are your thoughts on emerging technologies and their impact on compliance? How do you manage cross-jurisdictional compliance issues? What is your experience with investigating potential fraud cases? How do you work with law enforcement when it comes to compliance matters? What are your thoughts on the future of compliance?

Conclusion - Compliance & AML Officer

These are only a few of the many questions you could ask a compliance or AML officer during an interview. The key is to tailor your questions to the specific role you are hiring for, and to probe for both technical knowledge and personal qualities that will make the candidate successful in the role. With the right questions, you can find the perfect compliance or AML officer for your team.

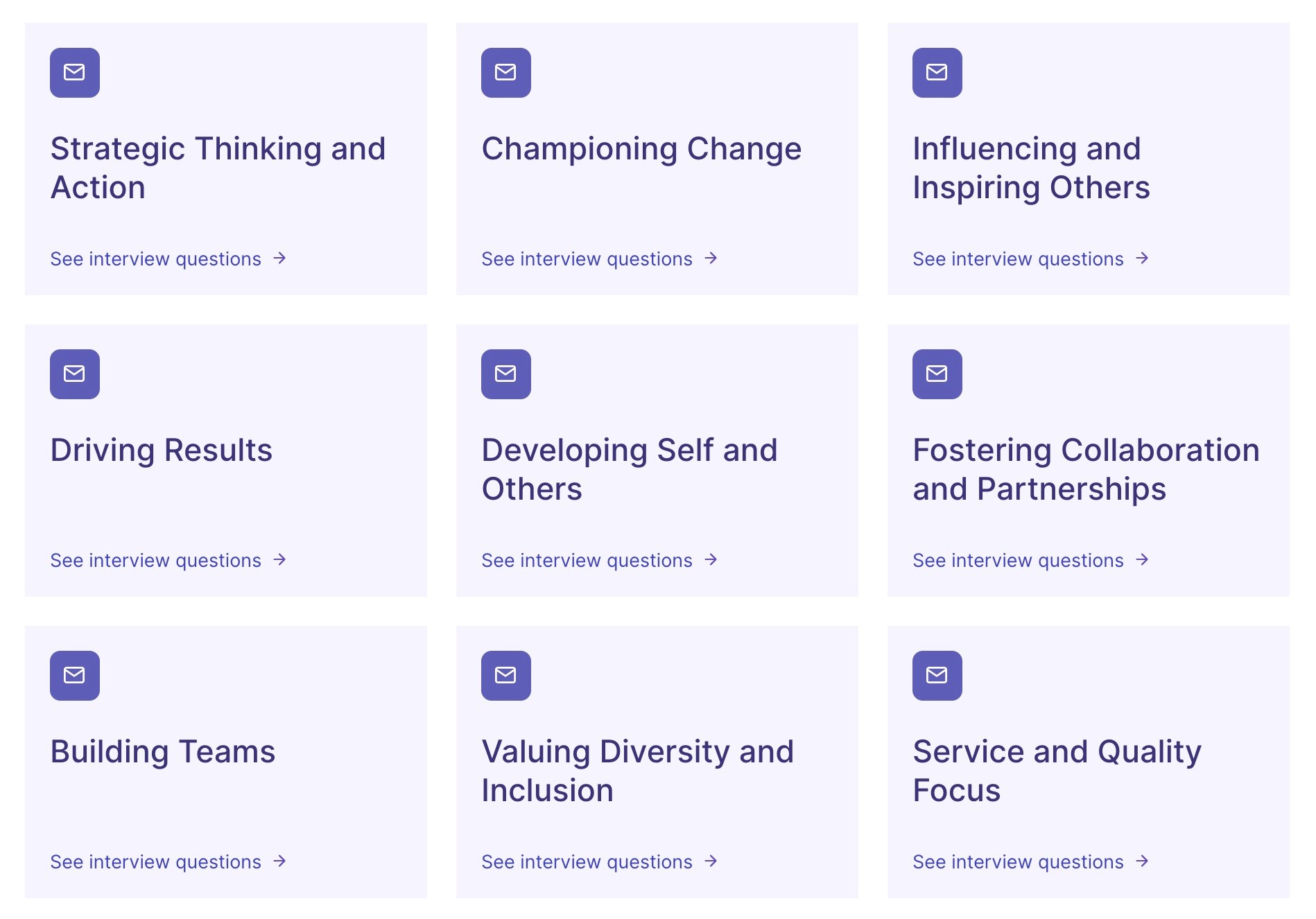

THE KEYSTONE OF EFFECTIVE INTERVIEWING IS HAVING GREAT INTERVIEW QUESTIONS

Browse Interview Questions by Role

No more hurriedly scribbled notes. Aspect delivers clear, detailed and custom AI summaries of every interview, capturing the nuances that matter.

Learn how to improve your interviewing technique with personalized feedback based on your interactions.

End-to-end integration: Aspect seamlessly integrates with your existing ATS systems, providing a unified hiring solution.

Beatriz F

People Success Specialist

Absolutely game-changing for busy recruiters!

The summary, the Q&A feature and the ATS integration have boosted my productivity and lowered the context-switching stress, the analytics provided allowed for me and my team to have full visibility over our stats, and Aspect's team couldn't be more helpful, friendly and accessible!

Diane O

CEO

Aspect adds rocket fuel to the hiring process.

Aspect helps me hire faster & more efficiently. I can create short highlight reels to share quickly with my team & clients for faster decision making. Faster, more informed decisions using Aspect has led to faster, better hires!

Lana R

Recruiter