Interview Questions

Finance BizOps & Strategy FP&A Manager Interview Questions

Hope you find this helpful! If you conduct a lot of interviews and want an AI-assistant to help you take all your notes and write and send human-level summaries to your ATS - consider trying out Aspect. It's free.

What is a Finance BizOps & Strategy FP&A Manager?

A finance BizOps & Strategy FP&A manager is responsible for the financial planning and analysis of a company's business operations and strategy. They collaborate with business leaders to develop and implement financial plans that support the company's business goals and objectives. The finance BizOps & Strategy FP&A manager is also responsible for providing financial analysis and insights to help inform and drive business decision-making.

“Acquiring the right talent is the most important key to growth. Hiring was - and still is - the most important thing we do.”

— Marc Benioff, Salesforce founder

How does a Finance BizOps & Strategy FP&A Manager fit into your organization?

The finance BizOps & Strategy FP&A manager is responsible for providing financial analysis and support to help the organization make sound business decisions. The finance BizOps & Strategy FP&A manager works closely with the CEO, CFO, and other members of the executive team to develop and implement financial plans and strategies. The finance BizOps & Strategy FP&A manager also provides guidance and support to other members of the finance team, including the financial analysts and accountants.

What are the roles and responsibilities for a Finance BizOps & Strategy FP&A Manager?

The finance BizOps & strategy FP&A manager is responsible for leading and managing the finance business operations and strategy team. The team is responsible for providing financial analysis, decision support, and business partnering to the finance organization. The finance BizOps & strategy FP&A manager will be responsible for developing and managing the team’s budget, forecasting, and reporting processes. The finance BizOps & strategy FP&A manager will also be responsible for developing and managing relationships with key stakeholders across the finance organization.What are the key responsibilities of the finance BizOps & strategy FP&A manager role? The key responsibilities of the finance BizOps & strategy FP&A manager role include • Leading and managing the finance business operations and strategy team.• Providing financial analysis, decision support, and business partnering to the finance organization.• Developing and managing the team’s budget, forecasting, and reporting processes.• Developing and managing relationships with key stakeholders across the finance organization.

What are some key skills for a Finance BizOps & Strategy FP&A Manager?

- Strong analytical and problem -solving skills: A finance bizops & strategy FP&A manager needs to be able to identify problems and opportunities, and then develop creative solutions that are aligned with the company’s business goals. Financial acumen: A finance bizops & strategy FP&A manager must have a strong understanding of financial concepts and principles in order to effectively manage the company’s finances. Business acumen: A finance bizops & strategy FP&A manager must also have a strong understanding of business principles and practices in order to effectively manage the company’s finances. Strong communication and interpersonal skills: A finance bizops & strategy FP&A manager must be able to effectively communicate with both internal and external stakeholders. Strong project management skills: A finance bizops & strategy FP&A manager must be able to effectively manage projects from start to finish. Strong leadership skills: A finance bizops & strategy FP&A manager must be able to effectively lead and motivate team members.

Top 25 interview questions for a Finance BizOps & Strategy FP&A Manager

What is your experience in financial planning and analysis? What is your experience in developing and managing budgets? What is your experience in financial modeling? What is your experience in forecasting? What is your experience in corporate finance? What is your experience in investment banking? What is your experience in management consulting? What is your experience in private equity? What is your experience in venture capital? What is your experience in investment management? What is your experience in financial analysis? What is your experience in business development? What is your experience in business operations? What is your experience in project management? What is your experience in strategy development? What is your experience in strategic planning? What are your thoughts on the role of finance in business? How do you think businesses should be structured financially? How do you think about risk and return when making investment decisions? What are some of the most important financial metrics that you pay attention to? How do you think about capital budgeting when making investment decisions? How do you think about valuation when making investment decisions? What are some of the most important considerations when structuring a deal? How do you think about negotiating when structuring a deal? How do you think about due diligence when structuring a deal? How do you think about exit strategies when structuring a deal? How do you think about financing when structuring a deal? What are some of the most important considerations when managing a portfolio of investments? How do you think about risk when managing a portfolio of investments? How do you think about return when managing a portfolio of investments? What are some of the most important considerations when making divestment decisions? How do you think about taxes when making divestment decisions? How do you think about expenses when making divestment decisions? What are some of the most important considerations when making succession planning decisions? How do you think about family dynamics when making succession planning decisions? How do you think about business dynamics when making succession planning decisions? What are some of the most important considerations when making estate planning decisions? How do you think about asset allocation when making estate planning decisions? How do you think about risk tolerance when making estate planning decisions? How do you think about return objectives when making estate planning decisions? What are some of the most important considerations when making philanthropic giving decisions? How do you think about impact when making philanthropic giving decisions? How do you think about financial return when making philanthropic giving decisions? What are some of the most important considerations when making impact investing decisions? How do you think about risk when making impact investing decisions

Top 25 technical interview questions for a Finance BizOps & Strategy FP&A Manager

How do you create value in a company? What are the key drivers of value creation in a company? How do you measure value creation? What are the key risks and opportunities that a company faces when pursuing growth? How do you assess a company's competitive position? What are the main types of financial analysis? How do you build a financial model? What are the key inputs into a financial model? What are the main types of valuation methods? How do you value a company? What are the key considerations when assessing an acquisition target? How do you integrate a company post-acquisition? What are the key challenges and opportunities when divesting a business? What is capital structure? How do you assess a company's capital structure? How do you optimize a company's capital structure? What is working capital management? How do you manage inventory? How do you manage receivables? How do you manage payables? What is cash management? How do you forecast cash flow? How do you manage liquidity risk? What is enterprise risk management? What are the main types of risks that a company faces?

Top 25 behavioral interview questions for a Finance BizOps & Strategy FP&A Manager

Tell me about a time when you had to manage a difficult or challenging project. Tell me about a time when you had to deal with a difficult customer or client. Tell me about a time when you had to lead a team through a difficult situation. Tell me about a time when you had to present complex financial information to senior management. Tell me about a time when you had to make a difficult decision. Tell me about a time when you had to manage multiple projects at the same time. Tell me about a time when you had to deal with a tight deadline. Tell me about a time when you had to troubleshoot a complex problem. Tell me about a time when you had to negotiate with someone. Tell me about a time when you had to handle a difficult customer complaint. Tell me about a time when you had to crunch numbers in a hurry. Tell me about a time when you had to give critical feedback to a team member. Tell me about a time when you had to make a presentation to senior management. Tell me about a time when you had to manage competing priorities. Tell me about a time when you had to deliver bad news to senior management. Tell me about a time when you had to manage expectations of senior management. Tell me about a time when you had to crunch numbers in order to meet a deadline. Tell me about a time when you had to troubleshoot a complex financial problem. Tell me about a time when you had to lead a team through challenging circumstances. Tell me about a time when you had to present complex information in an easily understandable way. Tell me about a time when you had to make a quick decision in order to meet a deadline. Tell me about a time when you had to negotiate with another department in order to get what you need for your project. Tell me about a time when you had to give critical feedback to another team in order to resolve a conflict. Tell me about a time when you had to make a presentation to the board of directors or another high-level group. Tell me about a time when you had to manage stakeholders with competing interests in order to achieve your project goals

Conclusion - Finance BizOps & Strategy FP&A Manager

As a Finance BizOps & Strategy FP&A Manager, you will be responsible for leading and managing a team of financial analysts who support the business operations and strategic planning of the company. You will be required to have a strong understanding of financial accounting, forecasting, and data analysis in order to make sound decisions for the company. In addition, you will need to be able to effectively communicate with other members of the executive team in order to ensure that everyone is on the same page regarding the company’s financial health.The following are some questions that you may be asked during an interview for a Finance BizOps & Strategy FP&A Manager position:1. What experience do you have in financial accounting and data analysis?2. What makes you a good fit for this role?3. What do you think are the most important skills for a successful Finance BizOps & Strategy FP&A Manager?4. What do you believe is the most important thing to remember when leading a team of financial analysts?5. What do you think are the challenges that come with this role?

THE KEYSTONE OF EFFECTIVE INTERVIEWING IS HAVING GREAT INTERVIEW QUESTIONS

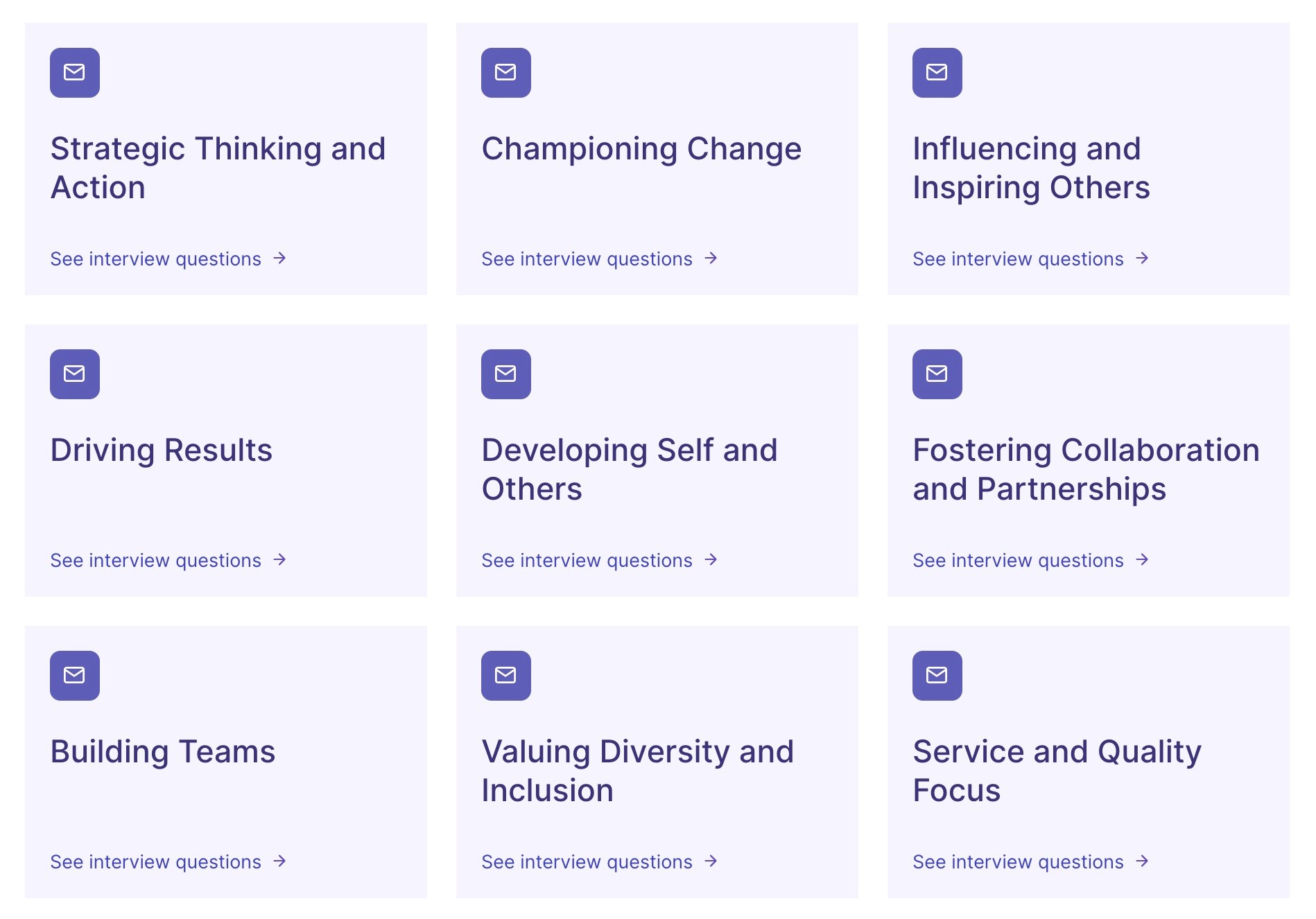

Browse Interview Questions by Role

No more hurriedly scribbled notes. Aspect delivers clear, detailed and custom AI summaries of every interview, capturing the nuances that matter.

Learn how to improve your interviewing technique with personalized feedback based on your interactions.

End-to-end integration: Aspect seamlessly integrates with your existing ATS systems, providing a unified hiring solution.

Beatriz F

People Success Specialist

Absolutely game-changing for busy recruiters!

The summary, the Q&A feature and the ATS integration have boosted my productivity and lowered the context-switching stress, the analytics provided allowed for me and my team to have full visibility over our stats, and Aspect's team couldn't be more helpful, friendly and accessible!

Diane O

CEO

Aspect adds rocket fuel to the hiring process.

Aspect helps me hire faster & more efficiently. I can create short highlight reels to share quickly with my team & clients for faster decision making. Faster, more informed decisions using Aspect has led to faster, better hires!

Lana R

Recruiter