Interview Questions

Insurance Product Analyst Interview Questions

Hope you find this helpful! If you conduct a lot of interviews and want an AI-assistant to help you take all your notes and write and send human-level summaries to your ATS - consider trying out Aspect. It's free.

What is a Insurance Product Analyst?

A insurance product analyst is a professional who assesses and analyzes insurance products and policies to determine their feasibility, profitability, and potential risks. They work with actuaries, underwriters, and other insurance professionals to develop new products and improve existing ones.What Does A Insurance Product Analyst Do?:The main goal of a insurance product analyst is to make sure that an insurance company's products are profitable and meet the needs of their customers. To do this, they must have a strong understanding of the insurance industry, the products that are available, and the needs of the customer base. They use this knowledge to assess new products and make recommendations for improvements to existing products.In addition to product analysis, insurance product analysts also develop marketing plans and conduct market research. They may also be involved in the development of new insurance products from start to finish, including working with actuaries to determine pricing and designing the product itself.What Are The Education Requirements To Become A Insurance Product Analyst?:Most insurance product analysts have at least a bachelor's degree in a field such as business, economics, or mathematics. Many also have a master's degree or higher. It is important for aspiring insurance product analysts to have strong analytical and research skills, as well as experience in the insurance industry.

“Acquiring the right talent is the most important key to growth. Hiring was - and still is - the most important thing we do.”

— Marc Benioff, Salesforce founder

How does a Insurance Product Analyst fit into your organization?

An insurance product analyst is responsible for the development and management of an insurance company's products. They work closely with actuaries, underwriters, and other professionals to assess risks and develop products that meet the needs of the company's customers.In order to be successful in this role, an analyst must have a strong understanding of the insurance industry and the various types of risks that exist. They must also be able to effectively communicate with other members of the organization in order to ensure that products are developed and managed in a way that meets the needs of the company.

What are the roles and responsibilities for a Insurance Product Analyst?

The insurance product analyst is responsible for the development, analysis, and implementation of insurance products. This includes working with actuarial, underwriting, and product management teams to develop new products, as well as analyzing and improving existing products. The analyst must have a strong understanding of the insurance industry, insurance products, and the regulatory environment.Essential Duties And Responsibilities • Develops new insurance products or enhancements to existing products, including market research, feasibility studies, pricing, and product design.• Performs analysis of insurance products, including trend analysis, claim analysis, financial analysis, and competitor analysis.• Implements new insurance products or changes to existing products, including coordinating with other departments, such as underwriting, actuarial, claims, and customer service.• Monitors ongoing performance of insurance products and makes recommendations for improvements.• Keeps abreast of developments in the insurance industry and provides input on the potential impact of these developments on the company’s products.• May provide training to other departments on the features and benefits of new or revised products.Knowledge, Skills And Abilities • Strong analytical skills.• Strong understanding of the insurance industry and insurance products.• Strong understanding of the regulatory environment.• Excellent communication skills.• Ability to work independently and as part of a team.

What are some key skills for a Insurance Product Analyst?

When interviewing candidates for an Insurance Product Analyst role, it is important to assess their skills in data analysis, product development, insurance knowledge, and project management.What is your experience with data analysis?How have you used data to improve a product or process?What is your experience with product development?How have you been involved in developing new products or features?What is your experience with insurance?How does your knowledge of insurance help you in this role?What is your experience with project management?How have you managed projects from start to finish?

Top 25 interview questions for a Insurance Product Analyst

What experience do you have working with insurance products? What do you know about the role of an insurance product analyst? What do you think are the key skills necessary for this role? What do you think are the most important qualities for success in this role? What do you think are the biggest challenges you would face in this role? What do you know about the insurance product development process? What do you think are the most important considerations when developing an insurance product? What do you think are the most important factors to consider when pricing an insurance product? What do you know about insurance product regulation? What do you think are the most important compliance considerations when developing an insurance product? What is your experience with data analysis? What do you think are the most important data considerations when developing an insurance product? What is your experience with actuarial modeling? What do you think are the most important actuarial considerations when developing an insurance product? What is your experience with financial analysis? What do you think are the most important financial considerations when developing an insurance product? What is your experience with market research? What do you think are the most important market research considerations when developing an insurance product? What is your experience with competitive analysis? What do you think are the most important competitive considerations when developing an insurance product? What is your experience with distribution analysis? What do you think are the most important distribution considerations when developing an insurance product? What is your experience with risk management? What do you think are the most important risk management considerations when developing an insurance product? What other experience do you have that you think would be relevant to this role? Why are you interested in this role? Why do you want to work for our company? What do you think makes our company’s products unique? Can you give me an example of a time when you identified a need for a new insurance product? Can you give me an example of a time when you led or played a major role in the development of an insurance product? Can you give me an example of a time when you utilized data analysis to improve an existing insurance product or develop a new one? Can you give me an example of a time when you utilized actuarial modeling to improve an existing insurance product or develop a new one? Can you give me an example of a time when you utilized financial analysis to improve an existing insurance product or develop a new one? Can you give me an example of a time when you utilized market research to improve an existing insurance product or develop a new one? Can you give me an example of a time when you utilized competitive analysis to improve an existing insurance product or develop a new one? Can you give me an example of a time when you utilized distribution analysis to improve an existing insurance product or develop a new one? Can you give me an example of a time when you utilized risk management to improve an existing insurance product or develop a new one? Can you give me an example of a time when you had to manage conflicting stakeholder interests during the development of an insurance product? Can you give me an example of a time when you faced significant challenges during the development of an insurance product and how you overcame them? Tell me about a time when you had to deal with complex regulatory issues while developing an insurance product. Tell me about a time when you had to manage multiple competing priorities while developing an insurance product. Tell me about a time when had to make difficult trade-offs while developing an insurance product. Tell me about a time when had to deal with unexpected challenges while developing an insurance product. Tell me about a complex problem that you solved during the development of an insurance product. Tell me about the most satisfying project that you worked on during your career thus far.

Top 25 technical interview questions for a Insurance Product Analyst

What is your experience with insurance product development? What is your experience with insurance pricing? What is your experience with actuarial science? What is your experience with underwriting? What is your experience with insurance claims? What is your experience with risk management? What is your experience with reinsurance? What is your experience with insurance product regulation? What is your experience with insurance product marketing? What is your experience with insurance product sales? What is your experience with insurance product customer service? What is your experience with insurance product accounting and finance? What is your experience with insurance product research and development? What is your experience with insurance product information technology? What is your experience with insurance product risk management? What is your experience with insurance product compliance? What is your experience with insurance product operations? What is your experience with insurance product management? What is your experience with insurance product strategy? What is your experience with insurance product pricing? What is your experience with insurance product underwriting? What is your experience with insurance product claims? What is your experience with insurance product reinsurance? What is your experience with insurance product marketing? What is your experience with insurance product customer service?

Top 25 behavioral interview questions for a Insurance Product Analyst

Tell me about a time when you had to analyze a complex data set and present your findings to a group of stakeholders. Describe a time when you had to use your analytical skills to solve a difficult problem. Tell me about a time when you had to explain your analysis to a non-technical individual. Tell me about a time when you had to present your findings in front of a large group. Describe a time when you had to use your analytical skills to figure out a creative solution to a difficult problem. Tell me about a time when you had to crunch numbers in order to make a business case for a new product or initiative. Describe a time when you had to use your analytical skills to figure out an efficient way to solve a problem. Tell me about a time when you had to analyze a large data set and present your findings to upper management. Describe a time when you had to use your analytical skills to figure out a solution to a difficult problem. Tell me about a time when you had to present your findings in front of a group of skeptical individuals. Describe a time when you had to use your analytical skills to find an innovative solution to a difficult problem. Tell me about a time when you had to crunch numbers in order to make an argument for a new product or initiative. Describe a time when you had to use your analytical skills to come up with an efficient solution to a problem. Tell me about a time when you had to analyze complex data and present your findings to upper management. Describe a time when you had to use your analytical skills to come up with an innovative solution to a difficult problem. Tell me about a time when you had to crunch numbers in order make an argument for change within the company. Describe a time when you had to use your analytical skills in order solve an unusual problem. Tell me about a time when you had explain your findings in front of a group of individuals who were not familiar with the topic. Describe a time when you had use your analytical skills in order come up with an efficient solution to an unusual problem. Tell me about time when you had analyze complex data and present findings in front of upper management. Describe a time when you had use analytical skills in order come up with an innovative solution an unusual problem.. Tell me abouttime when you had crunch numbers in order make business case for new product or initiative.. Describea timewhen you analytical skills solve difficult problem.. Tell me abouttime when youpresent findings front of large group.. 25 Insurance Product Analyst Behavioral Interview Questions: 1) How do you go about analyzing complex data sets? Can you give me an example? 2) What was the most difficult problem you ever faced as an insurance product analyst? How did you go about solving it? 3) How do you explain your findings to non-technical people? Can you give me an example? 4) Can you tell me about a time when you had to present your findings in front of a large group? How did you handle it? 5) What was the most creative solution you ever came up with as an insurance product analyst? Can you tell me about it?

Conclusion - Insurance Product Analyst

These are just a few of the many questions that you could be asked as an insurance product analyst during an interview. Be sure to do your research on the company you are interviewing with and their specific product lines in order to be fully prepared to answer any questions that come your way. Good luck!

THE KEYSTONE OF EFFECTIVE INTERVIEWING IS HAVING GREAT INTERVIEW QUESTIONS

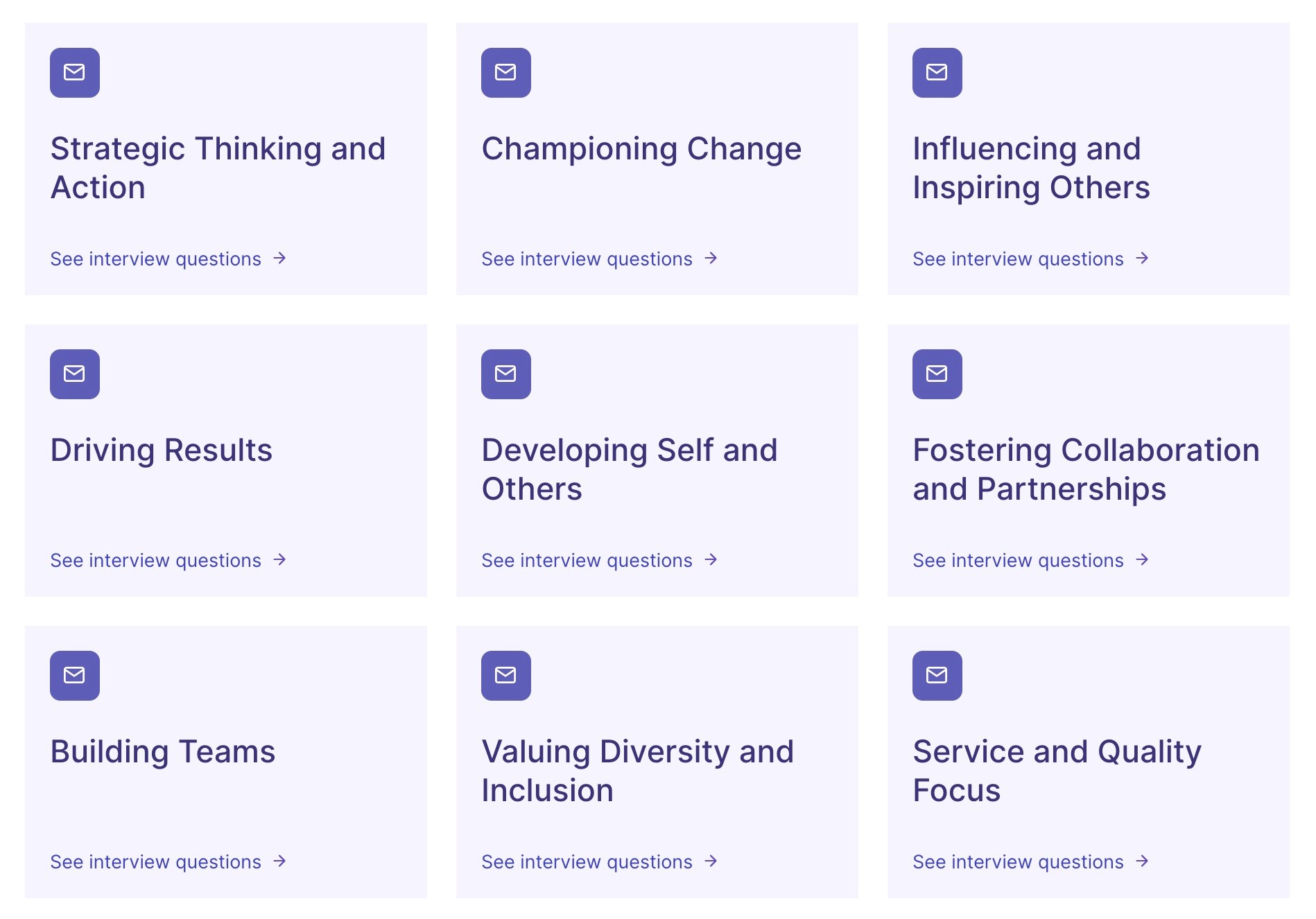

Browse Interview Questions by Role

No more hurriedly scribbled notes. Aspect delivers clear, detailed and custom AI summaries of every interview, capturing the nuances that matter.

Learn how to improve your interviewing technique with personalized feedback based on your interactions.

End-to-end integration: Aspect seamlessly integrates with your existing ATS systems, providing a unified hiring solution.

Beatriz F

People Success Specialist

Absolutely game-changing for busy recruiters!

The summary, the Q&A feature and the ATS integration have boosted my productivity and lowered the context-switching stress, the analytics provided allowed for me and my team to have full visibility over our stats, and Aspect's team couldn't be more helpful, friendly and accessible!

Diane O

CEO

Aspect adds rocket fuel to the hiring process.

Aspect helps me hire faster & more efficiently. I can create short highlight reels to share quickly with my team & clients for faster decision making. Faster, more informed decisions using Aspect has led to faster, better hires!

Lana R

Recruiter