Interview Questions

Payroll Accountant Interview Questions

Hope you find this helpful! If you conduct a lot of interviews and want an AI-assistant to help you take all your notes and write and send human-level summaries to your ATS - consider trying out Aspect. It's free.

What is a Payroll Accountant?

A payroll accountant is responsible for the financial aspects of an organization's payroll, including processing payroll, preparing payroll tax returns, and ensuring compliance with government regulations. A payroll accountant may also be responsible for other financial duties, such as Accounts Payable, Accounts Receivable, and General Ledger.

“Acquiring the right talent is the most important key to growth. Hiring was - and still is - the most important thing we do.”

— Marc Benioff, Salesforce founder

How does a Payroll Accountant fit into your organization?

A payroll accountant is an important part of any organization because they are responsible for ensuring that all employees are paid correctly and on time. They also work closely with the human resources department to make sure that all employee benefit deductions are taken care of correctly. Payroll accountants usually have a bachelor's degree in accounting or a related field.

What are the roles and responsibilities for a Payroll Accountant?

The payroll accountant is responsible for ensuring that all employees are paid correctly and on time. They may also be responsible for preparing and filing payroll taxes.Payroll Accountant Skills - Attention to detail - Organizational skills - Math skills - Ability to meet deadlines - Computer skills - Knowledge of payroll laws and regulationsPayroll Accountant Interview Questions What experience do you have with payroll? What software platforms are you familiar with? What processes do you typically use to calculate payroll? How do you ensure that all employees are paid correctly and on time? What are your thoughts on automating payroll processes? Do you have any experience preparing and filing payroll taxes? What do you think is the most challenging part of the payroll process? Have you ever encountered a payroll issue that you were unable to resolve? If so, how did you go about finding a solution? What do you think is the most important trait for a successful payroll accountant? Do you have any questions for me about the role?

What are some key skills for a Payroll Accountant?

Some important skills for a payroll accountant include being able to accurately input data, maintain confidentiality, handle sensitive information with care, work well under pressure, and be detail oriented.What education and experience is necessary to become a Payroll Accountant?Most payroll accountant positions require at least a bachelor’s degree in accounting or a related field. In addition, many employers prefer candidates who have previous experience working in payroll or accounting.

Top 25 interview questions for a Payroll Accountant

What accounting software do you feel most comfortable using? What is your experience with processing payroll? What is your experience with calculating payroll taxes? What is your experience with preparing payroll reports? What is your experience with auditing payroll records? What do you feel is the most important aspect of payroll accounting? What do you feel are the biggest challenges in payroll accounting? How do you stay up-to-date on changes in payroll law and regulations? What do you feel is the best way to resolve payroll discrepancies? Tell me about a time when you had to deal with a difficult payroll issue. Tell me about a time when you had to crunch numbers in a hurry. Tell me about a time when you had to deal with a complex payroll issue. Tell me about a time when you had to explain payroll information to someone who didn’t understand it. Tell me about a time when you had to research a payroll issue. What do you think is the most important trait for a successful payroll accountant? What education or training have you received in payroll accounting? How would you describe your work style? How do you handle stress while working on payroll deadlines? What are your career aspirations as a payroll accountant? Why are you interested in this position? Why do you think you’d be successful in this role? What do you think sets your experience apart from other candidates’? What do you think makes you the best candidate for this position? How would your references describe you? Have you ever been convicted of a crime? If yes, please explain.

Top 25 technical interview questions for a Payroll Accountant

How do you maintain payroll records? What is your experience with different types of payroll software? What is your experience with processing payroll taxes? How do you calculate payroll deductions? What are your thoughts on payroll compliance? What is your experience in auditing payroll records? What would you do if you discovered an error in an employee’s payroll records? What is your experience in preparing payroll reports? What is your experience in processing payroll direct deposits? How do you handle confidential payroll information? What are your thoughts on overtime pay? What is your experience in managing payroll deductions? How do you calculate vacation pay? What are your thoughts on sick pay? What is your experience in processing payroll garnishments? How do you calculate holiday pay? What are your thoughts on payroll taxes? What is your experience in preparing and filing payroll tax returns? How do you handle payroll tax audits? What are your thoughts on employee benefits? What is your experience in managing employee health insurance benefits? What are your thoughts on 401(k) plans? What is your experience in managing other types of employee benefits? Are you familiar with COBRA administration? Do you have any questions for me about the payroll accountant position?

Top 25 behavioral interview questions for a Payroll Accountant

Tell me about a time when you had to manage a complex payroll process. Describe a situation where you had to deal with a difficult or challenging customer or client. Tell me about a time when you had to manage a large volume of data or information. Tell me about a time when you had to juggle multiple priorities or deadlines. Tell me about a time when you had to troubleshoot a complex payroll issue. Describe a situation where you had to deal with a difficult or challenging co-worker. Tell me about a time when you had to manage a complex payroll tax issue. Tell me about a time when you had to deal with a difficult or challenging supervisor. Describe a situation where you had to research and resolve a complex payroll issue. Tell me about a time when you had to manage payroll for a large number of employees. Describe a situation where you had to deal with a difficult or challenging client call. Tell me about a time when you had to process payroll for a large number of employees. Tell me about a time when you had to troubleshoot and resolve a complex payroll issue. Tell me about a time when you had to manage multiple payroll processes simultaneously. Describe a situation where you had to deal with a difficult or challenging customer service call. Tell me about a time when you had to manage payroll for a high-volume employee population. Tell me about a time when you had to troubleshoot and resolve multiple payroll issues simultaneously. Describe a situation where you had to deal with multiple difficult or challenging customers or clients simultaneously. Tell me about a time when you had to process payroll for an especially large number of employees. Describe a situation where you had to manage and resolve multiple complex payroll issues simultaneously. Tell me about a time when you had to manage payroll for an especially high-volume employee population. Describe a situation where you had to troubleshoot and resolve multiple complex payroll issues for an especially large number of employees. Tell me about a time when you had to manage payroll tax issues for an especially large number of employees. Describe a situation where you had to research and resolve multiple complex payroll issues for an especially high-volume employee population. Tell me about a time when you had to manage multiple complex payroll processes for an especially large number of employees simultaneously.

Conclusion - Payroll Accountant

Overall, these are some great questions to ask a potential payroll accountant. By asking about their experience, education and understanding of payroll accounting, you can get a good sense of whether or not they would be a good fit for your company. Additionally, these questions can help you gauge their understanding of the payroll accounting process and whether or not they would be able to effectively manage your company's payroll.

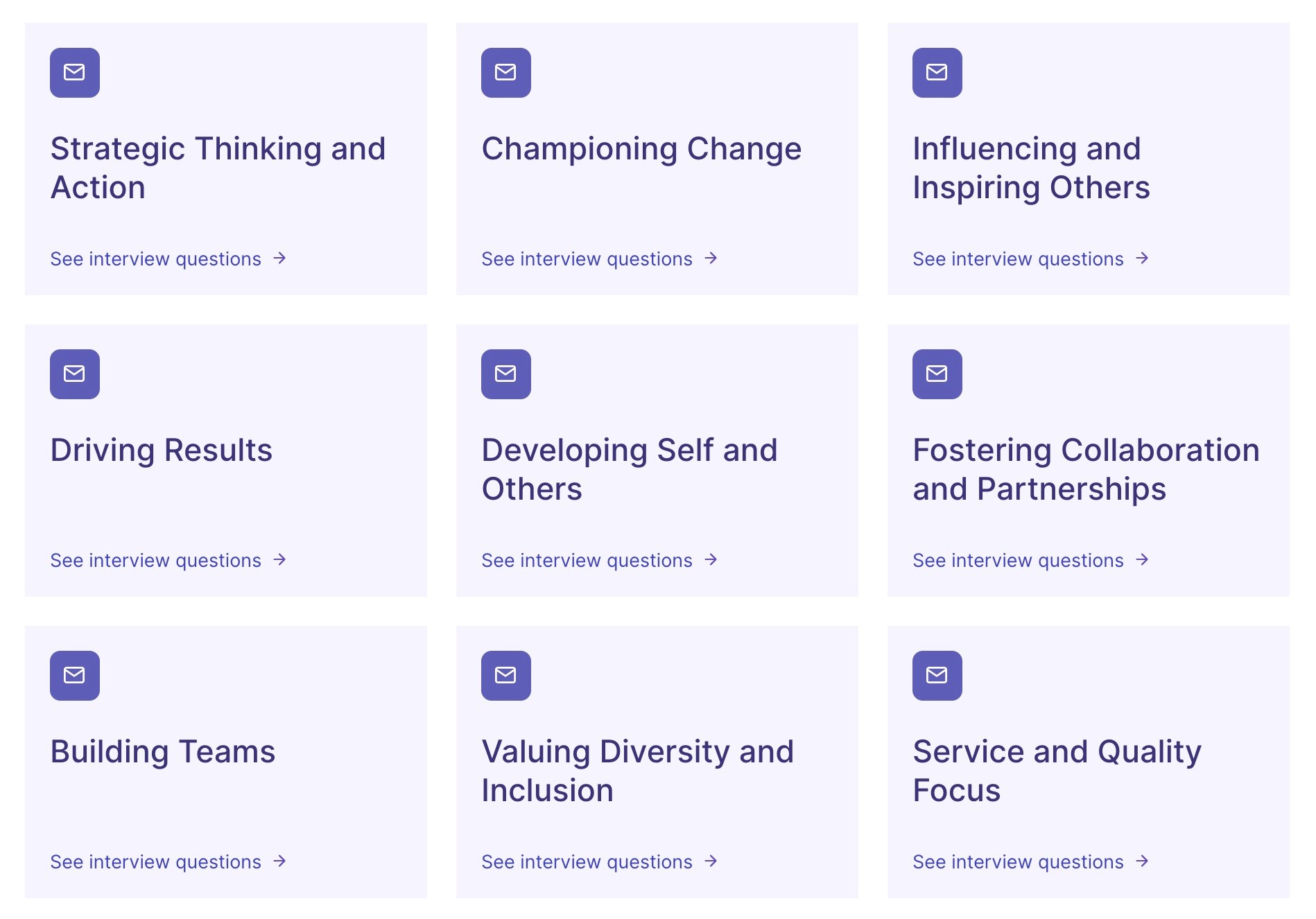

THE KEYSTONE OF EFFECTIVE INTERVIEWING IS HAVING GREAT INTERVIEW QUESTIONS

Browse Interview Questions by Role

No more hurriedly scribbled notes. Aspect delivers clear, detailed and custom AI summaries of every interview, capturing the nuances that matter.

Learn how to improve your interviewing technique with personalized feedback based on your interactions.

End-to-end integration: Aspect seamlessly integrates with your existing ATS systems, providing a unified hiring solution.

Beatriz F

People Success Specialist

Absolutely game-changing for busy recruiters!

The summary, the Q&A feature and the ATS integration have boosted my productivity and lowered the context-switching stress, the analytics provided allowed for me and my team to have full visibility over our stats, and Aspect's team couldn't be more helpful, friendly and accessible!

Diane O

CEO

Aspect adds rocket fuel to the hiring process.

Aspect helps me hire faster & more efficiently. I can create short highlight reels to share quickly with my team & clients for faster decision making. Faster, more informed decisions using Aspect has led to faster, better hires!

Lana R

Recruiter