Interview Questions

Quantitative Trader Interview Questions

Hope you find this helpful! If you conduct a lot of interviews and want an AI-assistant to help you take all your notes and write and send human-level summaries to your ATS - consider trying out Aspect. It's free.

What is a Quantitative Trader?

A quantitative trader is a financial analyst who uses mathematical models to make trading decisions. Quantitative traders typically work for investment banks, hedge funds, or other financial institutions. They use their knowledge of mathematics, statistics, and computer programming to develop and test trading strategies.The role of a quantitative trader is to find profitable trading opportunities and to execute trades that generate profits for their employer. Quantitative traders use a variety of methods to find trading opportunities. They may use technical analysis, which involves studying past market data to identify patterns that may indicate future price movements. They may also use fundamental analysis, which involves analyzing economic indicators such as interest rates, inflation, and employment data to identify potential trading opportunities. Quantitative traders typically use computer models to test their trading strategies. These models are used to simulate real-world market conditions and to estimate the potential profitability of a trading strategy. Once a quantitative trader has developed a trading strategy that they believe will be profitable, they will then execute trades in the real world.The role of a quantitative trader is to find profitable trading opportunities and to execute trades that generate profits for their employer. Quantitative traders use a variety of methods to find trading opportunities. They may use technical analysis, which involves studying past market data to identify patterns that may indicate future price movements. They may also use fundamental analysis, which involves analyzing economic indicators such as interest rates, inflation, and employment data to identify potential trading opportunities.Quantitative traders typically use computer models to test their trading strategies. These models are used to simulate real-world market conditions and to estimate the potential profitability of a trading strategy. Once a quantitative trader has developed a trading strategy that they believe will be profitable, they will then execute trades in the real world.

“Acquiring the right talent is the most important key to growth. Hiring was - and still is - the most important thing we do.”

— Marc Benioff, Salesforce founder

How does a Quantitative Trader fit into your organization?

A quantitative trader is a professional who uses quantitative methods to trade financial assets. They are responsible for the development and implementation of trading strategies, as well as the management of risk.In order to be successful, quantitative traders must have a strong understanding of financial markets and a deep knowledge of statistical methods. They must also be able to effectively communicate their ideas to others in the organization.The role of quantitative trader is often found in investment banks, hedge funds, and other financial institutions.

What are the roles and responsibilities for a Quantitative Trader?

The responsibilities of a quantitative trader vary depending on the employer, but they generally involve researching and developing trading strategies, analyzing financial data, and managing risk. Employers may also require quantitative traders to trade on behalf of the firm or clients, and to provide liquidity in the markets.Some quantitative traders work for banks, hedge funds, or other financial institutions, while others work for themselves as independent traders.Some common duties of a quantitative trader include • Researching and developing trading strategies• Analyzing financial data• Managing risk• Trading on behalf of the firm or clients• Providing liquidity in the markets

What are some key skills for a Quantitative Trader?

To be a successful quantitative trader, you should have strong math skills, analytical skills, and be able to understand and work with complex financial data. You should also be able to use trading software and platforms, and have experience with programming languages such as C++ or Java.What are some common interview questions for Quantitative Traders?Some common interview questions for quantitative traders include asking about their experience working with financial data, their understanding of financial markets, and their ability to use trading software and platforms. Candidates may also be asked to write code or solve mathematical problems during the interview process.

Top 25 interview questions for a Quantitative Trader

What is your experience with trading? What is your experience with quantitative analysis? What is your experience with statistical modeling? What is your experience with market analysis? What is your experience with risk management? What is your experience with portfolio management? What is your experience with financial analysis? What is your experience with derivatives trading? What is your experience with commodities trading? What is your experience with foreign exchange trading? What is your experience with algorithmic trading? What is your experience with high frequency trading? What is your experience with electronic trading? What is your experience with e-commerce? What is your experience with web development? What education and/or training do you have that relates to trading? How have you been able to successfully trade in the past? What do you believe are the key ingredients to success when trading? What do you think are the biggest mistakes that traders make? What do you think separates the successful traders from the unsuccessful ones? What do you think are the most important qualities that a successful trader must have? Can you give me an example of a time when you made a successful trade? Can you give me an example of a time when you made an unsuccessful trade? What do you think was the reason for the success or failure in each of those cases? Can you give me an example of a time when you took on too much risk? Can you give me an example of a time when you didn’t take enough risk? In each case, what do you think was the reason for the result? Do you have any particular risk management techniques that you use? Do you have any particular methods or techniques that you use to make trading decisions? Can you describe your process for making a trading decision? Can you give me an example of a time when you had to make a quick decision without having all of the information that you would have liked to have had? How did you go about making that decision and what was the result? Are there any specific markets or types of trades that you are particularly interested in or have expertise in? Do you have any thoughts on market microstructure or order execution? How do you think about transaction costs when making trading decisions? What do you think about slippage when entering and exiting trades? Have you ever encountered any problems with brokerages or counterparties in connection with your trading activities? Have you ever been involved in any disputes with other market participants? Are there any other issues that you think are important for traders to be aware of or consider? Do you have any thoughts on market regulation or the role of exchanges in the market place? Do anyone else in your family trade or work in the financial industry? How did you first get interested in trading and what motivated you to pursue it as a career? Do you know anyone else who trades or works in the financial industry who might be willing to speak with me about their experiences? Are there any other questions that I should be asking or anything else that I should know about trading or the financial industry that would be helpful in this interview process? Do you have any questions for me about the role or the firm?

Top 25 technical interview questions for a Quantitative Trader

What is the most important thing you look for when trading? What are the three most important factors you consider when making a trade? What is your risk tolerance? What is your approach to trading? What are your thoughts on market conditions? What are your thoughts on the current state of the economy? What is your favorite trading strategy? What is your worst trading experience? What have you learned from your best and worst trading experiences? What do you think sets you apart from other traders? What do you think is the most important trait for a successful trader? How do you approach trading when market conditions are unfavorable? What is your plan for dealing with losses? What do you think is the most important thing to remember when trading? What are your thoughts on risk management? What is your stop-loss strategy? What is your take-profit strategy? What is your trailing stop strategy? What is your position sizing strategy? What do you think is the most important thing to remember when managing your trades? What is your exit strategy? What do you think is the most important thing to remember when exiting a trade? What are your thoughts on portfolio management? How do you manage your trades?

Top 25 behavioral interview questions for a Quantitative Trader

How do you deal with stress and pressure? Tell me about a time when you had to make a quick decision under pressure. Describe a time when you had to go above and beyond to get the job done. Give me an example of a time when you had to think outside the box to solve a problem. Tell me about a time when you made a mistake and how you dealt with it. Describe a time when you had to deal with a difficult customer or client. Tell me about a time when you had to manage a large volume of work. Describe a time when you had to work with tight deadlines. Tell me about a time when you had to deal with conflicting priorities. Describe a time when you had to make a presentation or give a speech. Tell me about a time when you had to lead or manage a team. Give me an example of a time when you had to take charge of a situation. Describe a time when you had to deal with a difficult situation or person. Give me an example of a time when you had to use your analytical skills. Tell me about a time when you had to use your problem-solving skills. Describe a time when you had to use your negotiating skills. Tell me about a time when you had to use your research skills. Give me an example of a time when you had to make an important decision. Describe a time when you had to deal with a complex issue or problem. Tell me about a time when you had to manage multiple tasks or projects simultaneously. Give me an example of a time when you had to use your interpersonal skills. Describe a time when you had to use your communication skills. Tell me about a time when you had to give feedback or criticism to someone. Describe a time when you had to deal with a challenging situation or issue. Tell me about a time when you didn’t meet your goals or expectations.

Conclusion - Quantitative Trader

These are just a few of the many questions you could be asked in a quantitative trader interview. The key is to be prepared and know your stuff. Quantitative trading is a complex and rapidly-changing field, so make sure you stay up-to-date on the latest developments. Good luck!

THE KEYSTONE OF EFFECTIVE INTERVIEWING IS HAVING GREAT INTERVIEW QUESTIONS

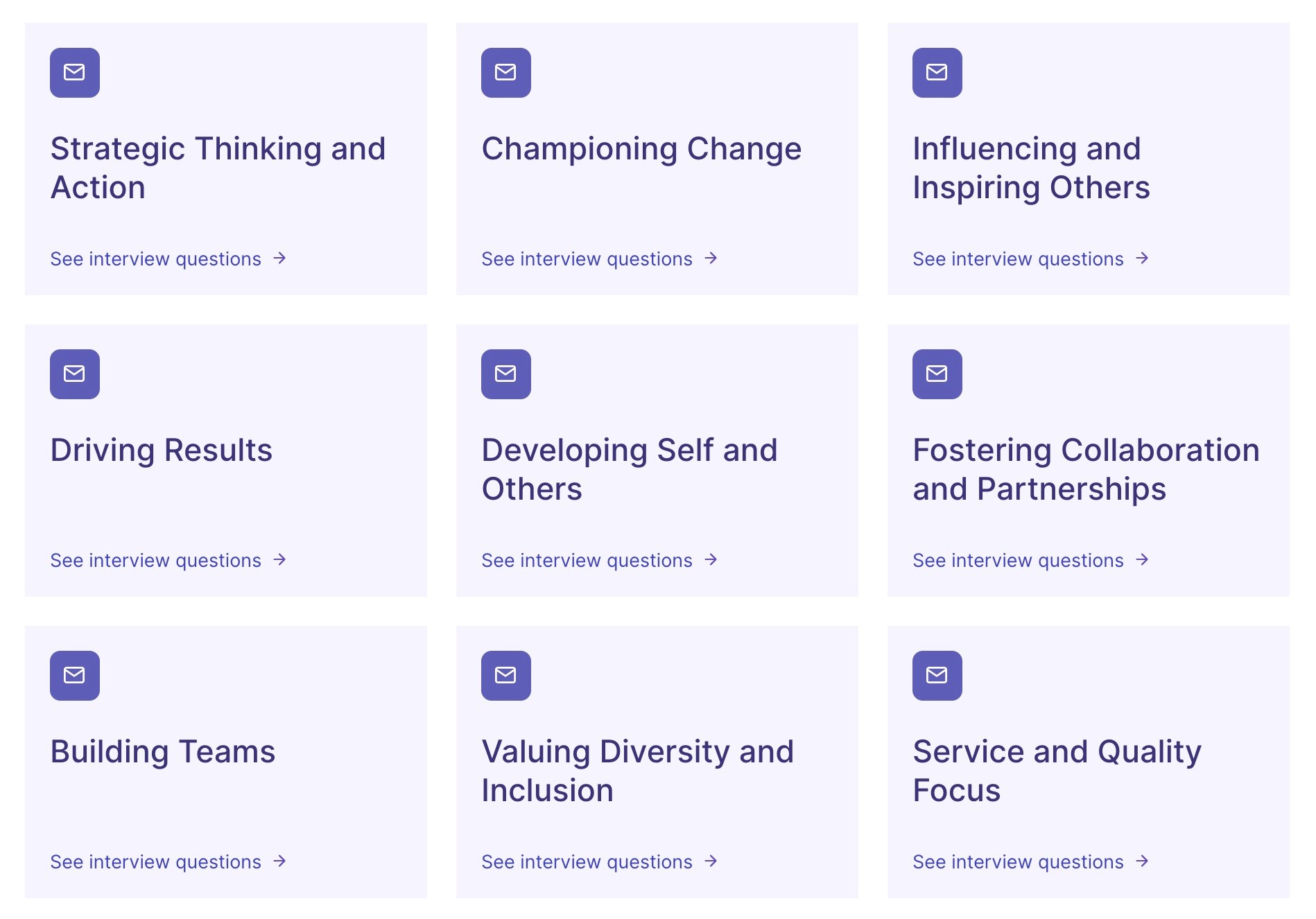

Browse Interview Questions by Role

No more hurriedly scribbled notes. Aspect delivers clear, detailed and custom AI summaries of every interview, capturing the nuances that matter.

Learn how to improve your interviewing technique with personalized feedback based on your interactions.

End-to-end integration: Aspect seamlessly integrates with your existing ATS systems, providing a unified hiring solution.

Beatriz F

People Success Specialist

Absolutely game-changing for busy recruiters!

The summary, the Q&A feature and the ATS integration have boosted my productivity and lowered the context-switching stress, the analytics provided allowed for me and my team to have full visibility over our stats, and Aspect's team couldn't be more helpful, friendly and accessible!

Diane O

CEO

Aspect adds rocket fuel to the hiring process.

Aspect helps me hire faster & more efficiently. I can create short highlight reels to share quickly with my team & clients for faster decision making. Faster, more informed decisions using Aspect has led to faster, better hires!

Lana R

Recruiter