Interview Questions

Risk Manager Interview Questions

Hope you find this helpful! If you conduct a lot of interviews and want an AI-assistant to help you take all your notes and write and send human-level summaries to your ATS - consider trying out Aspect. It's free.

What is a Risk Manager?

A risk manager is an individual who is responsible for assessing, managing and mitigating risks within an organization. A risk manager may work in a variety of industries, including banking, insurance, healthcare, manufacturing and government.The role of a risk manager is to identify potential risks that could impact the organization, and to develop plans to mitigate those risks. A risk manager may also be responsible for monitoring the organization's exposure to risk, and for reporting on the status of risks to senior management.Risk management is a critical function within any organization, and a risk manager must have a strong understanding of the various types of risks that can impact an organization. A risk manager must also be able to effectively communicate with senior management, and to develop and implement plans that will minimize the impact of risks on the organization.

“Acquiring the right talent is the most important key to growth. Hiring was - and still is - the most important thing we do.”

— Marc Benioff, Salesforce founder

How does a Risk Manager fit into your organization?

A risk manager is a professional who helps organizations identify, assess and manage risks. Risk managers typically work in the areas of insurance, finance and accounting. They may also work in other industries, such as healthcare, manufacturing and construction.

What are the roles and responsibilities for a Risk Manager?

The risk manager is responsible for identifying, assessing, and managing risks to the company. They work with other managers and departments to develop strategies to mitigate risks. The risk manager is also responsible for developing and implementing policies and procedures to minimize risks.Interview Questions For Risk Manager What experience do you have in risk management? What types of risks have you managed in the past? How did you identify risks in your previous roles? How do you assess the potential impact of risks? How do you develop strategies to mitigate risks? What policies and procedures have you developed to minimize risks? How do you monitor and report on risks? How do you communicate with stakeholders about risks? How do you ensure that risks are managed effectively? What challenges have you faced in risk management?

What are some key skills for a Risk Manager?

Some important skills for a risk manager include: -Analytical skills: Risk managers need to be able to identify and assess risk factors in order to develop effective mitigation strategies. -Communication skills: Risk managers need to be able to communicate effectively with all levels of an organization in order to ensure that everyone is aware of potential risks and the strategies in place to mitigate them. -Organizational skills: Risk managers need to be able to effectively organize and track information in order to identify trends and areas of potential risk. -Problem -solving skills: Risk managers need to be able to identify potential problems and develop creative solutions to mitigate them.What are some common duties of a Risk Manager?Some common duties of a risk manager include: -Developing and implementing risk management plans -Identifying and assessing risk factors -Developing mitigation strategies -Monitoring risk trends -Reporting on risk management activitiesWhat education is necessary to become a Risk Manager?Most risk management positions require at least a bachelor's degree, although some positions may require a master's degree or higher. Common majors for risk managers include business administration, finance, and accounting.

Top 25 interview questions for a Risk Manager

What are some of the most common risks that your organization faces? How do you prioritize risks in your organization? How do you go about assessing and measuring risks? What are some of the most effective ways to mitigate risks? What are some of the biggest challenges you face when it comes to managing risks? How do you stay up-to-date on the latest risk management practices? What are some of the best resources you use for risk management information? How do you develop and implement risk management policies and procedures? How do you communicate risk management information to stakeholders? How do you ensure that risk management is integrated into all aspects of the organization? What are some of the most common mistakes made in risk management? How can organizations avoid these mistakes? What are some of the biggest challenges you see organizations face when it comes to risk management? What are some of the best practices for managing risks? How can organizations effectively implement these practices? What are some of the most common pitfalls when it comes to risk management? How can these pitfalls be avoided? What are some of the biggest challenges you face when it comes to communicating risk information to stakeholders? How do you ensure that risk information is communicated effectively to stakeholders? What are some of the most common misunderstandings about risk management? How can these misunderstandings be avoided? What are some of the most effective ways to engage stakeholders in risk management? What are some of the most common challenges you face when it comes to engaging stakeholders in risk management? How can these challenges be overcome? What are some of the most effective ways to monitor and review risks? What are some of the most common challenges you face when it comes to monitoring and reviewing risks?

Top 25 technical interview questions for a Risk Manager

What is your approach to identifying and managing risk? What are some of the most common types of risks that you have seen in your experience? How do you assess the impact of risks on an organization? How do you prioritize risks for mitigation? What are some effective strategies for mitigating risks? How do you communicate risks to senior management and other stakeholders? How do you monitor and review risks on an ongoing basis? What are some common challenges that you have seen with implementing risk management programs? What are some best practices that you have seen for successful risk management? What are some common mistakes that organizations make with risk management? How can organizations improve their risk management practices? What are some trends that you are seeing in risk management? What challenges do you see in the future for risk management? How can technology help with risk management? What role does culture play in risk management? How can organizations foster a culture of risk management? What are some common pitfalls with using data for risk management? How can data be used effectively for risk management? What are some ethical considerations with risk management? What privacy concerns need to be considered with risk management? What are some cross-cultural issues to be aware of with risk management? How can organizations ensure that they are complying with relevant laws and regulations for risk management? What are some reputational risks to be aware of? How can organizations protect themselves from reputational risks?

Top 25 behavioral interview questions for a Risk Manager

Tell me about a time when you had to manage a complex and/or difficult risk situation. Describe a time when you identified an emerging risk and took steps to mitigate it. Tell me about a time when you had to make a difficult decision regarding risk management. Describe a time when you had to manage multiple risks at the same time. Tell me about a time when you had to deal with a high-stakes risk situation. Tell me about a time when you had to manage risk in an uncertain or volatile environment. Describe a time when you had to take on additional responsibility for risk management due to unforeseen circumstances. Tell me about a time when you had to report on risk management progress to senior management or the board of directors. Describe a time when you had to manage risk in the face of resistance or pushback from other stakeholders. Tell me about a time when you had to implement new or revised risk management policies or procedures. Describe a time when you had to troubleshoot and resolve an issue with the risk management system or process. Tell me about a time when you had to provide training or guidance on risk management to other stakeholders. Describe a time when you had to escalate a risk issue to senior management or the board of directors. Tell me about a time when you had to develop and present a risk management plan to senior management or the board of directors. Describe a time when you had to revise and update the risk management plan in response to changing circumstances or new information. Tell me about a time when you had to monitor and report on the effectiveness of the risk management system or process. Describe a time when you identified a weakness or gap in the risk management system or process and took steps to address it. Tell me about a time when you conducted a review or audit of the risk management system or process. Describe a time when you identified an opportunity to improve the risk management system or process and took action to implement the change. Tell me about a time when you encountered an obstacle in implementing the risk management system or process and overcame it. Tell me about a time when you had to deal with a non-compliant stakeholder in relation to risk management. Describe a time when you faced resistance or pushback from stakeholders in relation to your role in managing risk. Tell me about a time when you encountered difficulty in getting buy-in from stakeholders for your risk management approach. Describe a time when you had to manage risk in the face of budget constraints or other resource limitations. Tell me about a time when you faced a challenging or complex risk situation that required creative thinking and problem-solving skills

Conclusion - Risk Manager

Risk managers are responsible for identifying, assessing, and mitigating risks within an organization. They play a vital role in ensuring the safety and security of an organization’s employees, customers, and assets.When interviewing candidates for a risk management position, it is important to ask questions that will assess their ability to identify and mitigate risks.Questions you may want to ask include:1. What experience do you have with risk management?2. What methods do you use to identify risks?3. How do you assess the potential impact of risks?4. What mitigation strategies do you recommend for managing risks?5. Can you give me an example of a time when you identified and successfully mitigated a risk?6. What do you think is the most important aspect of risk management?7. What challenges do you see with implementing risk management within our organization?8. How would you go about developing a risk management plan for our organization?9. What role do you think communication plays in risk management?10. What do you think is the most important thing to remember when managing risks?

THE KEYSTONE OF EFFECTIVE INTERVIEWING IS HAVING GREAT INTERVIEW QUESTIONS

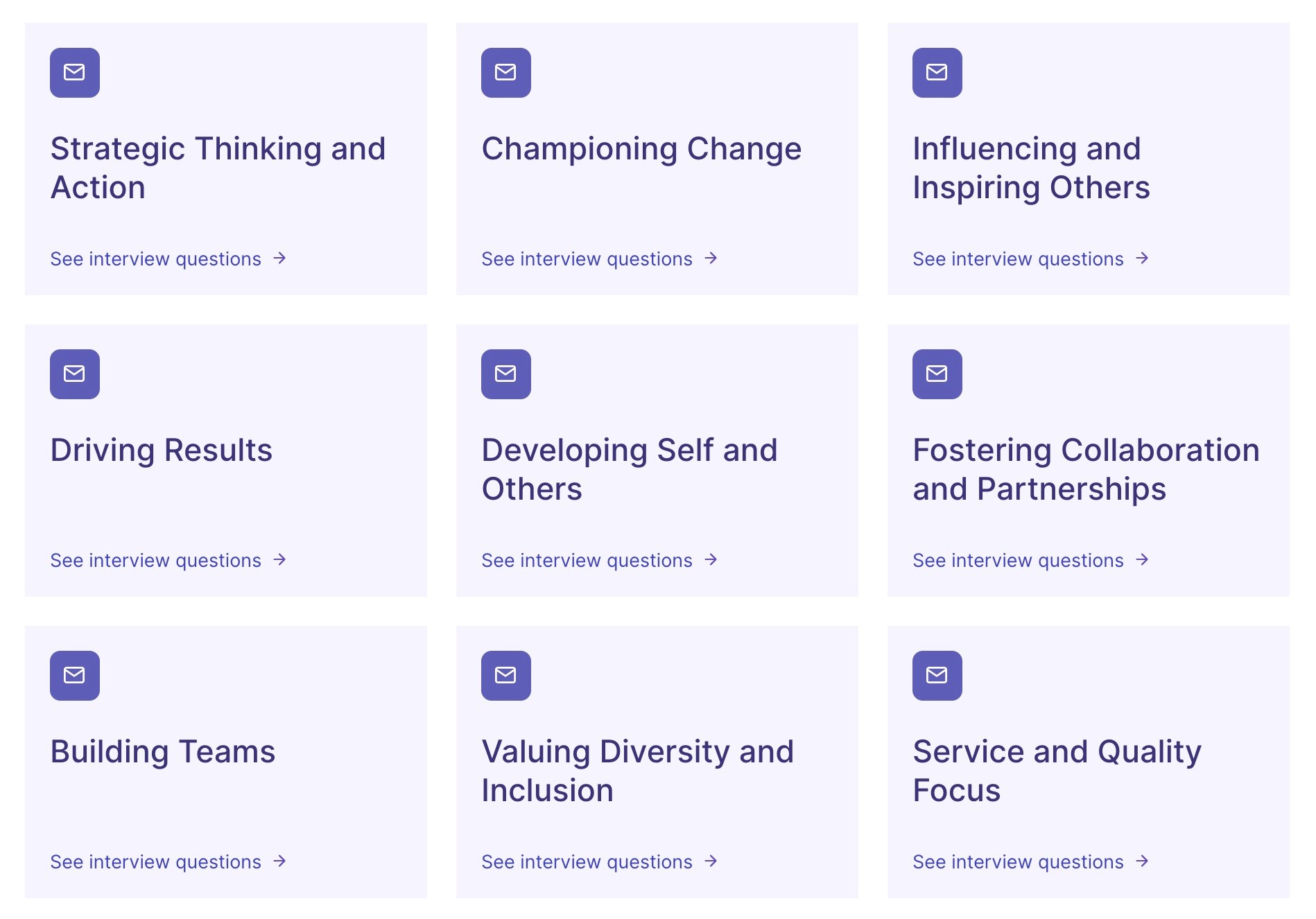

Browse Interview Questions by Role

No more hurriedly scribbled notes. Aspect delivers clear, detailed and custom AI summaries of every interview, capturing the nuances that matter.

Learn how to improve your interviewing technique with personalized feedback based on your interactions.

End-to-end integration: Aspect seamlessly integrates with your existing ATS systems, providing a unified hiring solution.

Beatriz F

People Success Specialist

Absolutely game-changing for busy recruiters!

The summary, the Q&A feature and the ATS integration have boosted my productivity and lowered the context-switching stress, the analytics provided allowed for me and my team to have full visibility over our stats, and Aspect's team couldn't be more helpful, friendly and accessible!

Diane O

CEO

Aspect adds rocket fuel to the hiring process.

Aspect helps me hire faster & more efficiently. I can create short highlight reels to share quickly with my team & clients for faster decision making. Faster, more informed decisions using Aspect has led to faster, better hires!

Lana R

Recruiter